Saving Money on Insurance Costs

I’m currently looking into ways to lower my current car insurance costs without compromising coverage.

Has it been a while since you shopped around for car insurance? There is a very good chance that you are paying too much for your insurance and could get a better rate as well.

If you believe you are overpaying for your current insurance, this is a reminder that there are savings (of several hundred dollars a year) to be had out there. I’ve found that the more insurance companies you compare, the more savings and better coverage you are able to find.

![]()

Every little bit helps!

The following are some tips that will be covered in this post:

- Ask about discounts

- Bundle

- Compare rates / shop around for different quotes

- Raise your deductible

- Reduce coverage

Lowering Insurance Costs – Tip #1 – Ask About Discounts

Ask About Discounts

“It cant hurt to ask.”

There are plenty of auto insurance discounts out there to help you lower your car insurance rates.

But what type of discounts may be available? I’ve compiled a list below.

Car Insurance

- Car Safety Features

- Examples include Antilock brakes and Antitheft devices

- Multi Car

- If you insure more than one car on the same policy

- Multi Policy

- If you buy multiple policies from the same insurer (home and car insurance, for example)

- Accident Free/Prevention

- Some insurers offer discounts for taking Defensive Driving courses

- Good Student Discounts

- Applies to high school and college students getting good grades

- Low-mileage

- Some insurers offer discounts for keeping your annual mileage low (Usually 15,000 or less miles/year)

- Senior citizens

- Eligible for drivers usually over the age of 55

- Group / Associations

- Some insurers partner with various associations to give discounts to members

- Safe / Good Driver

- For drivers with no traffic violations or accident claims. Insurers usually look at the last three years of your driving record to make a determination.

- Plug a monitoring device in your car track driving habits (i.e. Progressive’s Snapshot)

- Defensive Driving courses

- Lower portions of your auto insurance by up to 10% for 3 years

- Paid in Full

- Discount for paying entire premium at once

Home Insurance

- Home renovation

- New electrical and plumbing systems, for example

- New roof

- New home

- If home was built in the past 15 years

- Non smokers

- Discounts for having no smokers living in the home

- Energy-efficient features

- Home safety features

- Alarms

Lowering Insurance Costs – Tip #2 – Bundle

Bundle

If you currently have your auto, home, or life insurance from different insurers, you are probably missing out on a discount.

Put simply, if you bundle policies from a single company, they’re very likely to offer you a multi-policy discount of an average of about 8%.

Having the same insurance provider for your homeowners and auto insurance could save you a few hundred dollars a year. That number varies depending on where you live, though, according to a study from insuranceQuotes.

This is one of the smartest and easiest ways to save money (and time!) on insurance.

Lowering Insurance Costs – Tip #3 – Compare Rates

Compare Rates / Shop Around

This step will save you some money, but may be the most time consuming.

It is recommended that you get at least three price quotes from different companies. These can typically be obtained online (websites like Progressive.com, InsuranceQuotes.com, and CoverHound.com) if you aren’t a phone person. Some upfront information will be needed in order for the rates to be determined.

If you’re already insured, assess how much current coverage you have so you can compare against new policies. Know your vehicles safety features, how many miles you drive each year, claims history, etc.

If you’re unhappy with your current insurer, it is wise to tell them that you’re considering a switch. They may offer you a discounted rate in order to keep you as a customer. If you do decide to switch, be sure not to cancel until you get another policy.

This is something you should be doing every few years even if you’re happy with your current provider, in order to make sure you’re getting a competitive rate. You get little benefit from sticking with the same insurer year in and year out. Not browsing for other policies could cost you more in the long run, even if you believe you are paying less than you were before.

![]() In New York, Progressive tends to be cheaper for singles and couples, while Geico or Travelers tends to cheaper for families with teens

In New York, Progressive tends to be cheaper for singles and couples, while Geico or Travelers tends to cheaper for families with teens

![]() Consider comparison shopping on TheZebra.com or SmartFinancial, websites that quickly offer estimates from a large number of insurance providers

Consider comparison shopping on TheZebra.com or SmartFinancial, websites that quickly offer estimates from a large number of insurance providers

![]() Consider also using an independent insurance agent to help you find you the best deals on the coverage that’s right for you

Consider also using an independent insurance agent to help you find you the best deals on the coverage that’s right for you

Lowering Insurance Costs – Tip #4 – Raise Your Deductible

Raise Your Policy Deductible

This tip is the one of the easiest ways to save money on insurance (as much as 30%), but you must be willing and able to afford to pay more on a claim.

The higher the deductible = The lower the premium. The recommended or standard deductible is at least $500 (you’ll save up to $260/year by raising to this amount). If you increase that amount to, say $1000 (recommended), you will save money on your insurance. Be sure to call your insurance company and ask to raise your deductible.

During my research, one interesting perspective that I found was this:

“We should change our perception that insurance of any type is intended to cover all of our expenses when we incur a claim. Those days are over. Think of insurance as risk sharing. How much risk are you willing to assume?”

Thoughts?

Lowering Insurance Costs – Tip #5 – Reduce coverage

Reduce Coverage You Do Not Need

This tip mainly applies to those with older cars that have low market value (worth less than 10x your premium). Dropping collision and/or comprehensive coverage on these type of vehicles may be a wise choice, as the claim amount is unlikely to exceed the cost of the insurance and deductible amount. This is, of course, is contingent on ones financial situation.

J. Robert Hunter, director of insurance with the Consumer Federation of America, advises this:

“Take your comp and collision premium and add it up, then multiply it by 10. If your car is worth less than that, don’t buy the coverage.”

Websites such as Kelley Blue Book or Edmunds.com will allow you to determine your car’s worth. If you’re driving an older model that is worth less than 10 times your insurance premium, consider dropping these types of coverage.

![]() Never buy a policy that just meets the minimum liability limits required by your state, which is typically below the standard 100/300/100

Never buy a policy that just meets the minimum liability limits required by your state, which is typically below the standard 100/300/100

![]() For home insurance, be sure to get replacement-cost coverage rather than an actual-cash-value policy

For home insurance, be sure to get replacement-cost coverage rather than an actual-cash-value policy

Lowering Insurance Costs – Tip #6 – Limit Your Driving

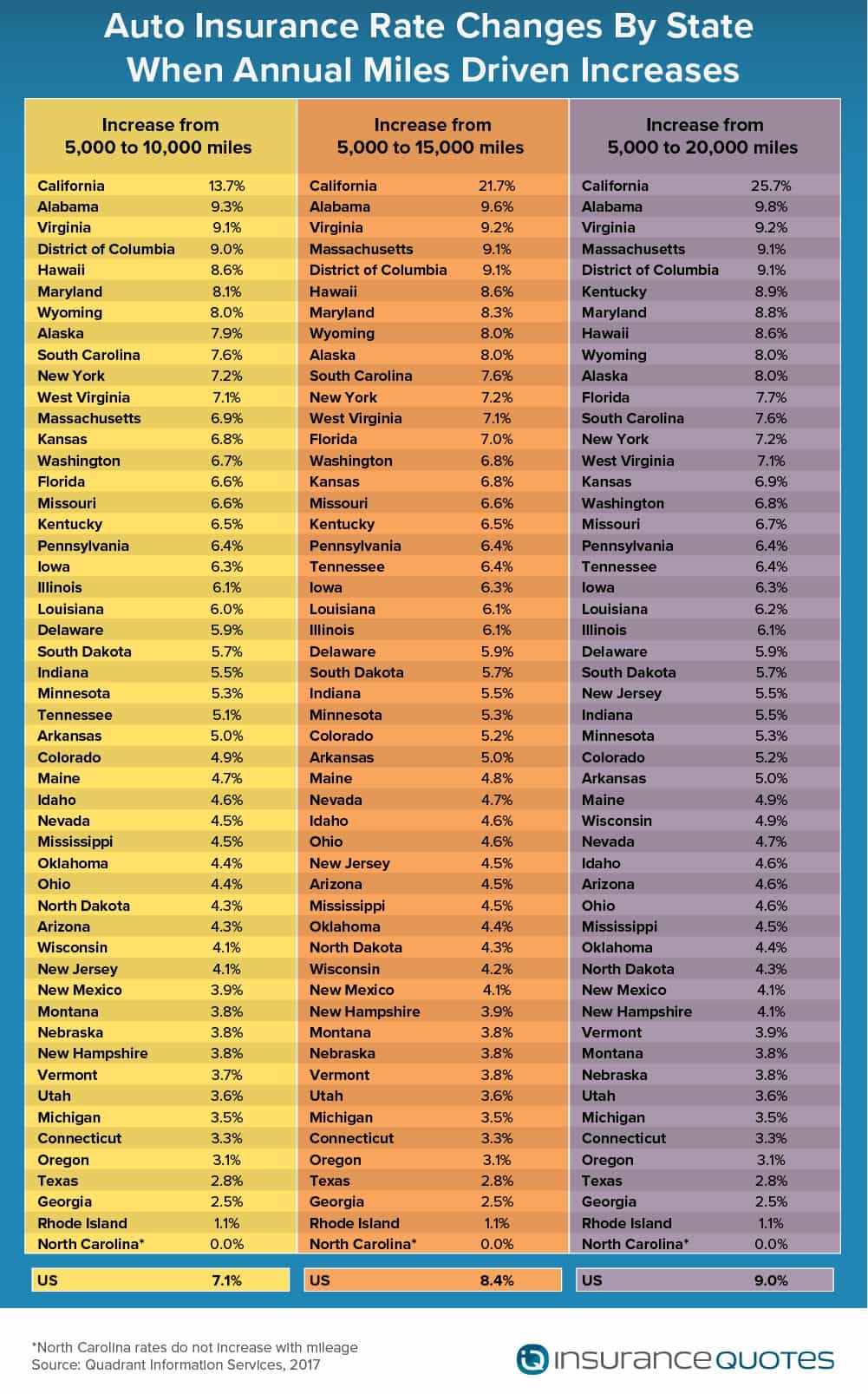

More Miles = Higher Rates

Some states see as much as 26 percent more on their bills because of extra miles.

She found Metromile, a San Francisco-based startup trying to revolutionize the auto insurance industry. It offers low-mileage drivers a unique new option: Pay-as-you-go insurance coverage.

![]() Metromile, a San Francisco-based startup offers low-mileage drivers pay-as-you-go insurance coverage.

Metromile, a San Francisco-based startup offers low-mileage drivers pay-as-you-go insurance coverage.

Factors That Increase Premiums

- Having poor credit

- Having a DWI

- Adding a teen

- Boys cost more than girls in this regard

- Students under the age of 25 who show proof of good academic performance can earn significant discounts, however

- Having at-fault accidents

- Having not-at-fault accidents

- Having moving violations

- Buying a luxury vehicle

Factors That Decrease Premiums

- Becoming a homeowner (buying a house)

- Bundling homeowners insurance with car insurance can save an average of $240/year

- Increasing your collision deductible

- Graduating college

- Getting married

- Two people in their 30s who get married and combine policies can save an average of $525/year

Insurance Switch

Comment below with your own tips and success stories!