What is a credit score?

→ It is a three-digit number based on a number of factors such as your payment history and diversity of credit.

→ Overall, it is a way to measure how well you’ve managed money in the past and also an indicator of how well you’ll continue to manage money in the future.

→ Banks and credit card companies use this number to determine if they want to lend money to you

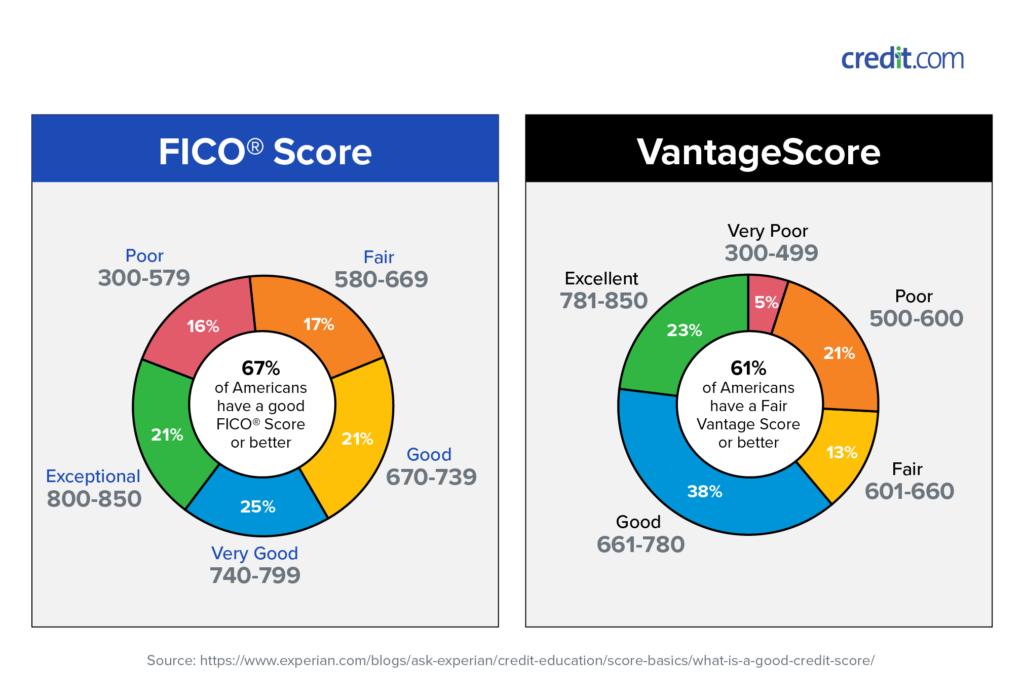

→ Credit scores can range from 300 to 900. A score above 650 is generally considered a “good” score by lenders.

→ The three major credit bureaus (Experian, TransUnion and Equifax) are who keep track of your loan and payment history an assign you a three digit number. See below for an overview of the main scoring models they use to calculate it.

——————————————————————————————

Credit Scoring Models

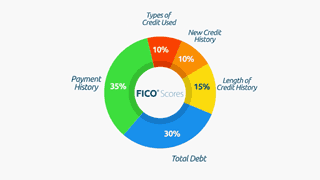

The five-factor FICO scoring model

FICO groups the information into five categories, with each one representing a percentage of your score.

Payment history: 35%

Amounts owed: 30%

Length of credit history: 15%

New credit: 10%

Credit mix: 10%

VantageScore

This model includes a sixth factor and weights things a little differently.

Payment history: extremely influential

Age and type of credit: highly influential

Percentage of credit limit used: highly influential

Total balances and debt: moderately influential

Recent credit behavior and inquiries: less influential

Available credit: less influential

——————————————————————————————

Things That DO Impact Your Credit Score

♦ Applying for multiple credit cards at once ♦

This signals to the credit reporting agencies that you could be in financial trouble. Avoid opening too many new accounts too quickly.

♦ High Balances ♦

In other words, credit reporting agencies are looking at your credit utilization (debt-to-credit ratio). This is essentially how much of your available credit limit you’ve used up. A high ratio indicates you may be charging more than you can afford. Be sure to keep the balances low on your credit cards and pay them off as fast as you can.

♦ Late Payments ♦

“Just one late payment can hurt your score and will remain seven years from the date of the missed payment” – Rod Griffin of Experian

Late payments also indicate that you may be having financial trouble. The longer the payment has been overdue, the higher impact it will have on your score.

TIP: Make sure to know the grace period on your bills

Things That DO NOT Impact Your Credit Score

♦ Unpaid parking and traffic tickets (municipal records) ♦

♦ Unpaid library books fees ♦

♦ Checking your credit score a lot ♦

——————————————————————————————

Ways To Fix Your Credit Score

- Pay your bills on time — and in full — every month

- Make consistent, on-time payments on your bills and loans

- Make sure your credit report is accurate by regularly reviewing it carefully for mistakes (if you find an error make sure to submit a dispute)

- Focus on keeping your “credit utilization ratio” (the amount of your credit limit) below 10%

- Get a credit card but be sure to use it properly and make on-time payments

- Take care of late payments and unpaid debts – take steps to get organized and solve the issue

Check out Credit Sesame to get your credit score completely FREE! You’ll also get access to your credit score, any debt-carrying accounts and a handful of personalized tips to improve your score. You’ll even be able to spot any errors holding you back.

Credit Sesame is a 100% free personal finance credit and debt management tool with no credit card required or trial period

Here’s what you’ll get access to when you register with Experian Boost™ today:

- Ability to increase your FICO® Score with Experian Boost™

- Free Experian Credit Report and FICO® Score

- Experian Credit Report and FICO® Score refreshed every 30 days on sign in

- FICO® Score monitoring with Experian Data

- Experian credit monitoring and alerts

- Free dark web surveillance report

- Credit cards and loans matched for you